Are You Eligible for a Medical Expense Tax Deduction?

January 4, 2022

Economic Impact Payment Letter Can Help with the Recovery Rebate Credit

January 8, 2022IRS News: Information Letters to Advance Child Tax Credit Recipients

(via National Society of Accountants)

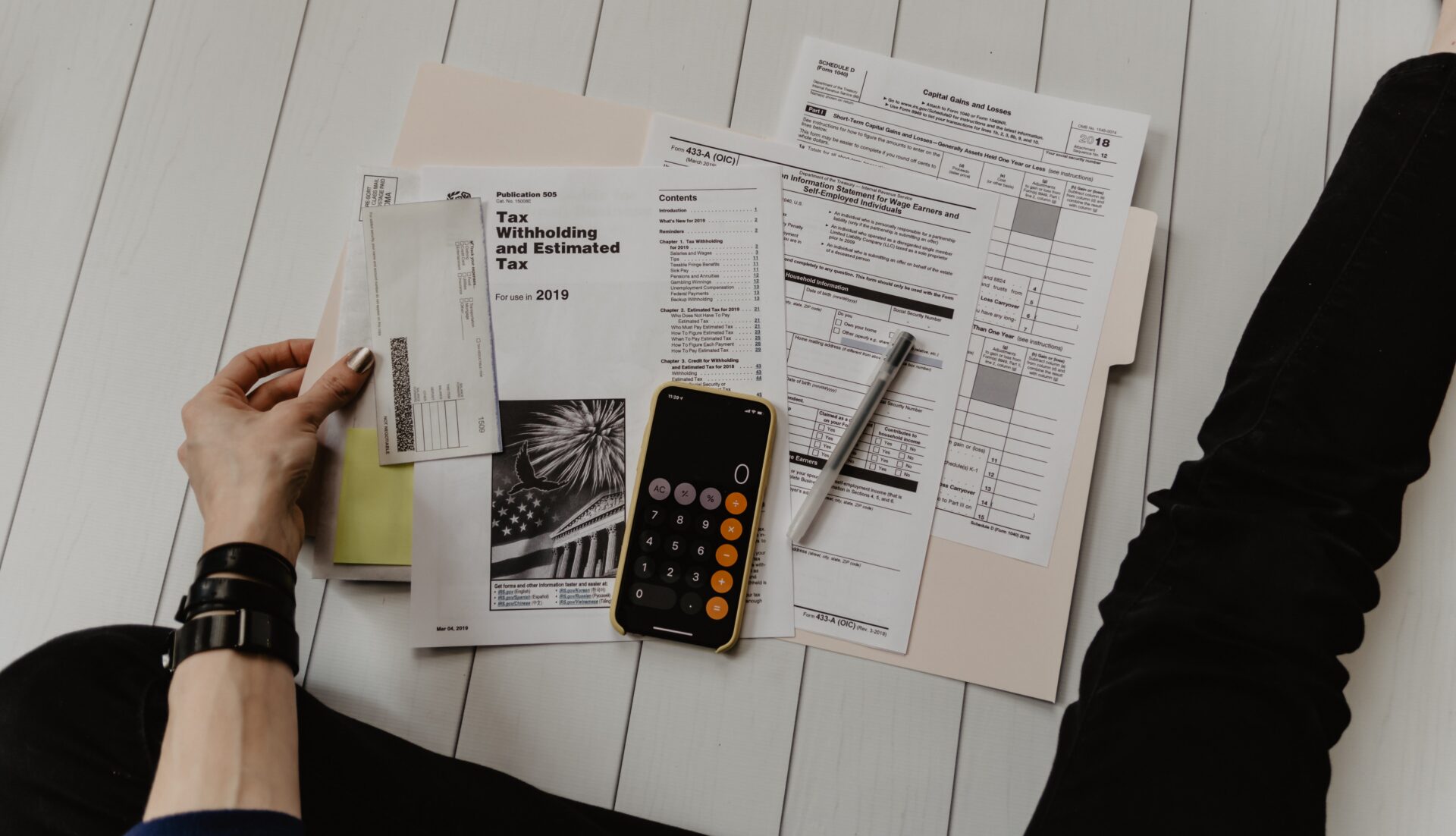

IRS issues information letters to Advance Child Tax Credit recipients and recipients of the third round of Economic Impact Payments. Taxpayers should hold onto letters to help the 2022 Filing Season experience.

Watch For Advance Child Tax Credit Letter

To help taxpayers reconcile and receive all of the Child Tax Credits to which they are entitled, the IRS has sent Letter 6419 and 2021 advance CTC in late December 2021. This will continue into January 2022. The letter includes the total amount of advance Child Tax Credit payments taxpayers received in 2021 and the number of qualifying children used to calculate the advance payments. People should keep this and any other IRS letters about advance Child Tax Credit payments with their tax records.

Families who received advance payments will need to file a 2021 tax return and compare the advance Child Tax Credit payments they received in 2021 with the amount of the Child Tax Credit they can properly claim on their 2021 tax return.

The letter contains important information that can make preparing their tax returns easier. People who received the advance CTC payments can also check the amount of their payments by using the CTC Update Portal available on IRS.gov.

Eligible families who did not receive any advance Child Tax Credit payments can claim the full amount of the Child Tax Credit on their 2021 federal tax return, filed in 2022. This includes families who don’t normally need to file a tax return.

Link to article: IRS ACTC Letters (contentsharing.net)